Dopamine App gives you the tools you need to invest in crypto-assets and earn your financial freedom.

With the continuous growth of the crypto ecosystem, crypto investment means more than just prices and volumes. Whether it be a swarm of publications from the $SHIBA army or a couple of tweets from Elon Musk, social media sentiment became a vital element of the crypto market, and Dopamine has the perfect tool to harness to power of social media sentiment analysis: LunarCrush.

LunarCrush in brief: crypto sentiment analysis made easy

Essentially, LunarCrush is a cryptocurrency social media sentiment aggregator. There are several free and premium crypto sentiment analysis tools, but LunarCrush is by far our favorite. The platform gathers dozens of metrics from social media and exchanges to create a comprehensive overview of the crypto market.

The Market section: the heart of sentiment analysis in LunarCrush

When you arrive on LunarCrush, the platform will bring you to the dashboard below. On this dashboard, you can track your portfolio and your favorite coins after setting it up. So far, nothing outstanding most platforms offer you these features. What’s truly valuable for the crypto investor on LunarCrush is sentiment analysis. To access LunarCrush’s sentiment analysis of the crypto market, go to the “Markets” section on the top right corner of your screen.

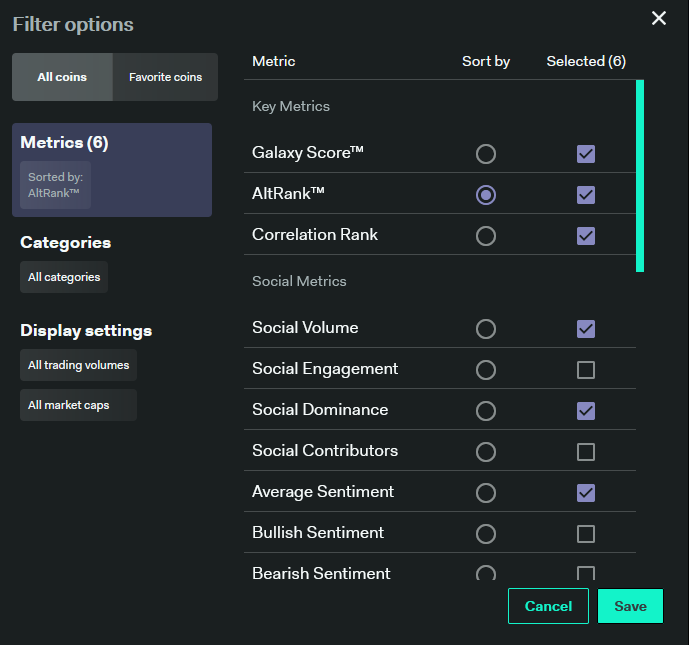

On the platform’s “Markets” section, you’ll find a second dashboard packed with data and insights. On the upper left part of the dashboard, you’ll find several filtering options. In the “Metrics” section, you can choose which data to display and the sorting parameters. Here we want to sort coins by AltRank and display data relative to social sentiment. You can display up to 28 metrics divided into 3 categories: Key Metrics, Social Metrics, Trading Metrics.

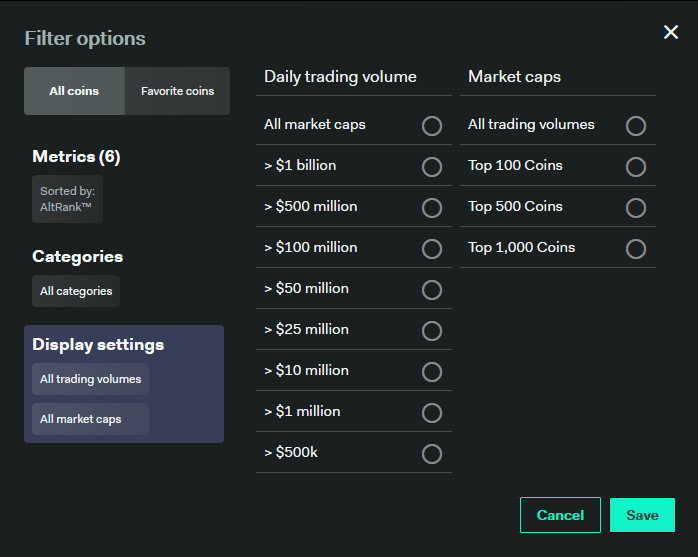

Then, you can also sort the assets by categories to study a specific sector of the crypto market like DeFi tokens, Meme coins, or the Binance Smart Chain ecosystem. Lastly, you can filter coins by trading volume or by market cap to exclude some tokens from your analysis; it depends on what you’re looking for.

If you’re looking for a long-term safe bet with good social engagement, it might be best to only look at the Top 100 Coins by market cap and exclude the coins with a Daily trading volume below $10 million. By looking at coins in the top 100 with a daily volume above $10 million ordered by Altrank, you’ll undoubtedly find some trending assets to bet on.

Sentiment analysis using LunarCrush

If you’re looking for a high-risk, high-reward play on an undervalued coin, you’ll want to select “All market caps” and exclude tokens with a trading volume below $500k. Here, you can either order the tokens by AltRank or by market cap and add a category filter to exclude coins from less promising crypto segments. Among the categories proposed by LunarCrush, it’s interesting to study the DeFi tokens or specific ecosystems – like the BSC, the Solana ecosystem, or the Terra ecosystem – to find an undervalued gem with huge potential returns.

As discussed, LunarCrush presents you with 28 metrics for each coin, but today we’ll focus yourselves on two of them: the Galaxy Score and the AltRank. Those metrics are the secret sauce of Lunar Crush. Like all secret sauces, they have secret ingredients.

Up until October 2021, LunarCrush gave all users full access to the metrics used to compute de Galaxy Score and the AltRank. But, the platform recently underwent a full resign and only give access to the components to the advanced users that gathered points by completing tasks to reach Level 3 on LunarCrush.

The Solana Case

To demonstrate the power of LunarCrush, we’ll use one of the hottest assets in the crypto space, the $SOL token from Solana Labs. Solana is a blockchain that strives to solve some of the industry’s most pressing problems: improving speed and scalability without sacrificing decentralization or network security.

Solana’s ultimate goal would therefore be to solve the blockchain trilemma, which assumes that a decentralized network can only satisfy two of the following three properties: decentralization, security, and scalability. Finally, Solana boasts of being the fastest blockchain in the world. The Solana network can process 50,000 transactions per second.

The price of SOL has grown by leaps and bounds throughout 2021. SOL has established itself permanently in the market capitalization rankings with over 13,000% growth and an all-time high around the $215 level.

As you can see on the graphic above, the SOL token has a Galaxy Score of 67.5 and is ranked 2nd in the altcoin rankings, but what does it mean?

The Galaxy Score

The Galaxy Score rates tokens from 1 to 100 by analyzing a cocktail of metrics. According to the platform, the Galaxy Score aggregates 4 sets of metrics:

- Price Score — The Price Score is a score (1 to 5) derived from the moving averages of this asset giving an indication about the asset momentum. A high score mean the asset is experiencing a strong upward momentum.

- Social Sentiment — The Average Social Sentiment (ASS) rate the overall bullishness or bearishness of what people are saying online (1 to 5). If crypto-enthusiasts are expressing negative feelings about the token, the ASS will go down.

- Social Impact Score — The Social Impact Score (SIS) measures the total social activity involving the asset. The SIS aggregate the volume of interactions – likes, retweets, upvotes, etc. – linked to the asset across several social media platforms – Twitter, Reddit, YouTube – and cross it with the global social volume. This gives us an insight into user engagement with post related to a given coin, on a scale from 1 to 5.

- Correlation Rank — A LunarCrush algorithm that determines the correlation between the social data and the coin price/volume, on a scale from 1 to 5.

The AltRank

The AltRank algorithm creates a ranking of the 3,065 tokens listed on LunarCrush by measuring price performance, volumes, and social media activity. The lower the AltRank, the better:

- Percent Change 24h — AltRank compares the price performance of an asset relative to Bitcoin price performance. Then, it ranks each asset depending of its performance over the last 24 hours.

- Trading Volume — Since there are a lot of altcoins, most of them have small trading volumes. When it’s the case, the assets are harder to trade accurately. AltRank looks at the trading volume of each coin and ranks altcoins in terms of trading activity.

- Social Volume — Here, LunarCrush analyze the total social activity across both social media (Twitter, Reddit, etc.) and news sources. The overall number of posts then allows the platform to rank each asset depending on the number of mentions.

- Social Score — The Social Score is similar to the SIS from the Galaxy Score, the only difference is the scale. With this last metric, the algorithm analyzes the social engagement to compute a score for each asset, used to rank them.

How to invest in crypto assets using LunarCrush insights?

Having access to all this data is nice; being able to use them efficiently is even better. Here you have the SOL AltRank over 7 days. Since the SOL recently reached a new ATH, it has an excellent performance rating, generating tremendous trading and social volumes, thus raising SOL to first place in the altcoins ranking.

But, if you followed the asset carefully, you could have predicted this price appreciation. As you can see, SOL’s Altrank was oscillating around 200th until the 20th of October where it went down to 84th. As we saw previously, the AltRank going down toward 1 is a good sign.

Since SOL’s AltRank is going down and its price didn’t go up, we can assume its social and trading volumes are going up. With that in mind, we can deduce that many people are talking about this asset and trading it, which generally leads to price appreciation, and that’s how things went. SOL’s AltRank went from 200 to 84 on the 20th of October at 11 a.m CEST, and SOL’s price rose more than 35% to reach a new ATH soon after.

Settings up alerts on LunarCrush

To avoid constant monitoring of your favorite coins, you can set up alerts on LunarCrush. On the right-side summary screen of each asset, you have the option to add an alert based either on the Galaxy Score or the AltRank. Here, we’ve set up an alert that will send a text message on our phone each time Solana’s token AltRank is less than 5 for the day. Like we discussed above, the best-performing assets have a high Galaxy Score and a low AltRank.

As you can see, if we had set up this alert on the 1st of January 2021, we would have received 25 alerts. Then, if we acted on these alerts, we would have gained 9% on average on our trades in 24 hours. Letting the trades run for a week makes the average return even more significant, with an average of 22% price appreciation a week after the alert.

Once again, LunarCrush demonstrates the power of sentiment analysis in the financial markets. Now that you have a good understanding of why sentiment analysis is critical in the crypto market, we’ll go more in-depth on how you can leverage the power of sentiment analysis in the second part of this article. Stay connected!

🌹 🌹 🌹 🌹