In the first part of this series on sentiment analysis in the crypto market, you discovered how LunarCrush’s algorithm performs its sentiment analysis. Here, you’ll learn how to use LunarCrush’s insights to harness the power of sentiment analysis and ride the most promising crypto trends to maximize your gains.

Dopamine gives you the tools you need to invest in crypto-assets and earn your financial freedom.

How to detect trends using LunarCrush’s sentiment analysis

The crypto space is an ever-changing landscape with projects rising top and others falling in disgrace each and every day. However, it is possible to observe some trends in this whirlwind of financial innovation. Some trends are long-term ones others stay for a couple of months before vanishing.

As of November 2021, the crypto ecosystem experienced two main trends this year. The first one is the meteoric rise of the decentralized finance (DeFi) ecosystem. The second one is the continuous hype around NFTs. But, within those trends not all tokens are equal, some relentlessly reach new ATHs, while the rest just follow the momentum induced by the hottest assets. This is the “winner takes all” principle.

So, in order to make some profits by riding a trend, you need to identify the winners. On the dashboard above you can see the Top 10 tokens by AltRank in early November. What can we deduce from this ranking?

Firstly, we can see several coins linked to the non-fungible token (NFT) and gaming ecosystem. The first rank is the SAND token from Sandbox. Then, we have the MANA token from Decentraland which takes 3rd place in the ranking. Moreover, the CHZ, CHR, and ENJ tokens are also linked to the NFT ecosystem.

Secondly, we have two tokens that recently breached their ATHs: LRC from Loopring and DOT from Polkadot.

If we take a look at SAND and MANA charts, we can immediately see that the assets provided huge returns over the last 9 months with more than 39,500% price appreciation for SAND and 6,300% for MANA. Since both coins reached their ATH in early November there was a lot of social media chatter around them which in turn helped them reach the top of the rankings on LunarCrush.

How to act on those insights?

Naturally, to make the most out of a trend you have to be among the first mover. Meaning once an asset reached the top of the rankings, it might be too late to ride the trend. Consequently, you have to do research and explore LunarCrush in-depth to see which asset is creeping up in the rankings because of social media chatter and/or price appreciation.

From the Top 10 by Altrank presented above, we can deduce several insights and once we put them in context we can act on them. On this screenshot, we have 50% of the assets that are linked to the NFT and broader metaverse ecosystem. This is mainly due to Facebook’s announcement regarding its rebranding as Meta and its intention to invest 10 billion into the metaverse ecosystem. Since one of the biggest internet companies in the world stated its will to build a worldwide metaverse, assets linked to this sector began appreciating as we can observe on the SAND chart.

Here we can assume that the metaverse and NFT are currently in an upward trend. But the Facebook announcement was just the little nudge those assets needed to take the spotlight, they were already trending for months without being at the top of the altcoins rankings.

If you want to act now on the NFT & Metaverse trend fueled by Facebook, you have to take a careful approach, since those assets are near their highest levels.

How to plan for a bull run with LunarCrush’s sentiment analysis

“History never repeats itself, but it does often rhyme.”

Mark Twain

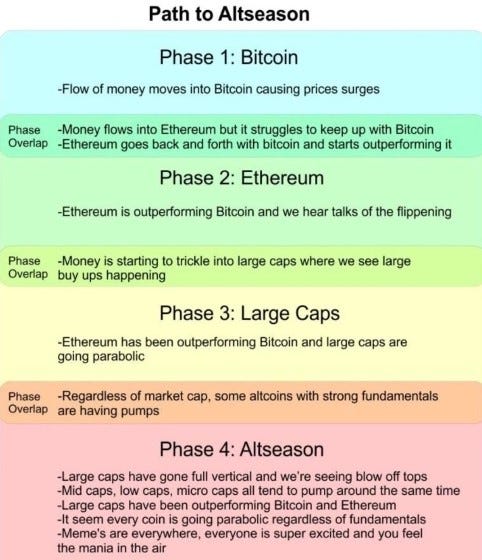

Since 2012, which is considered the first true Bitcoin bull run, each and every bull run followed the same structure in terms of money flow. The first step of a true bull run is Bitcoin rising and reaching a new ATH and the last step of the process is the mythical Altseason where tokens often labeled as “shitcoins” do x10, or even x100 in a week.

The Path to Altseason

Since we pretty much know how the bull run will go down, we can plan for it to maximize our profits. The first 2 phases are self-explanatory. To get enough momentum for a proper run, we need a strong Bitcoin with some media coverage. Then you’ll see Bitcoin rising on LunarCrush, which is really rare. During this initial phase, it’s smart to allocate a good chunk of your crypto portfolio to Bitcoin while keeping an eye out to detect some eventual new trends like we previously saw.

Then, Ethereum will start to outperform Bitcoin, like in March and April 2021, and all of crypto Twitter will start speaking about the famous “Flippening”. This term refers to the possibility of the market capitalization of Ethereum (ETH) overtaking the market capitalization of Bitcoin (BTC).

With the 3rd phase of the bull run, things are becoming interesting for us. In crypto, an asset is considered a Large Caps or a Big Cap when its market capitalization reaches 10 billion dollars. Right now, we have around 20 Large Caps according to CoinMarketCap.

January 2021: The first part of the bull run

During the first phase of the 2021 bull run, this path to Altseason verified itself once again. From January to March Bitcoin’s price doubled from $25,000 to $50,000 then Ethereum took over and outperformed Bitcoin going from $1,400 to $4,300.

After the first two phases, we saw Large Caps and forgotten coins leading the charge to higher highs. You can see this by looking at Bitcoin Cash (BCH) or Litecoin’s (LTC) charts. Between the 23rd of March and the 12th of May both the prices of the assets increased by 200% while Bitcoin and Etheereum went sideways, they basically didn’t do anything. Last but not least, in May the altcoins and shitcoins took the spotlight. This is when most of us learned about the Shiba Inu (SHIBA) which increased by more than 2,000% in a couple of weeks.

November 2021: Phase 2 of the Altseason is here

Currently, we’re in the second part of the 2021 bull run, and since history rhymes, you can observe the exact same path to the alt season unfolding. Bitcoin reached a new ATH in October, then Ethereum did the same in November. Now you can expect some of the Large Caps to appreciate over the following weeks before the rest of the ecosystem gains traction.

How to detect greed with LunarCrush’s sentiment analysis

There are two ways to detect greed in the crypto market using LunarCrush:

- When the meme coins creep up in the rankings

- When the small caps creep up the rankings

If you see tokens like the ones below going up in the altcoin rankings, you can be sure that people are talking about and buying memic crypto assets in a worldwide speculating frenzy. Currently, you can smell a slight fragrance of greed, everyone is talking about Shiba Inu and the next meme coin to appreciate by 10,000%.

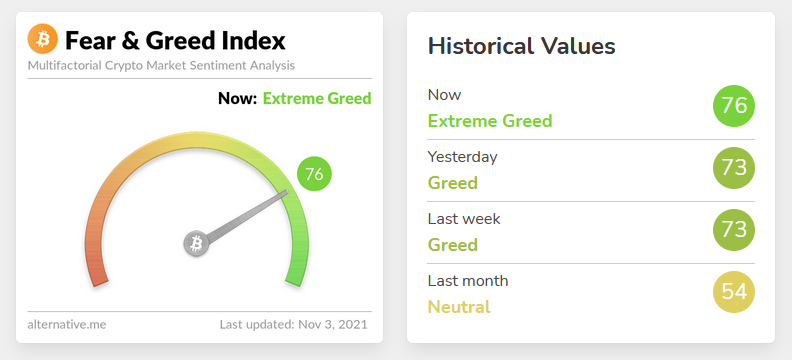

To verify your assumption on how greedy the market participants are, you can check the Fear and Greed Index in the Discover section of Dopamine App. As you can see, in early November the market is feeling pretty greedy. This is mainly due to Bitcoin and Ethereum’s fresh ATH. Since the leading crypto assets are showing strength, the rest of the market is following them and the market participants feel confident.

When the meme coins and the small caps are up in the rankings on LunarCrush and the Fear & Greed Index stays in extreme Greed for multiple weeks, you can be sure that the entire market is being greedy. As a smart investor, you might want to use this opportunity to take some profits before the market starts crashing because it always will.

How to call the bottom during a market crash with LunarCrush

After a prolonged period of extreme greed, the market will always correct, no matter the market, no matter the period. If you’ve smelled the greed and taken your profits, you’re in the perfect position to serenely buy your favorite cryptos after a market crash.

But how do you know if the prices have finally bottomed out?

In trading, there is a saying, “don’t try to catch falling knives”. This means you have to wait for a bottom to start buying or the asset you buy might fall even lower. One way to know when the prices have bottomed out is to look at the stablecoins Altrank.

Above you can see that the highest-ranking stablecoin is the Tether (USDT) at the 184th position. Since the market is expériencing an upward trend no one buys stablecoins and everyone sells them for other crypto assets. However, during panic phases and market crashes all the market participants will rush to their favorite stablecoin, which will propel them in the top 10 of the rankings in LunarCrush. When everyone sold their crypto for stablecoins, the Tether USD other stablecoins should show up on LunarCrush’s first page.

Now that you fully understand the power of LunarCrush’s sentiment analysis, the only thing left to do is to create an account on the platform and start exploring the altcoins rankings to find the next gem that will bring your portfolio to the moon!

Recent Comments