Decentralized crypto lending platforms provide loans to anyone with a wallet and some crypto collateral. But, with the growth of the DeFi ecosystem, you can find it hard to choose the best lending platform. Don’t fret, Dopamine is here to help you with your choice.

Aave, the innovative lending platform

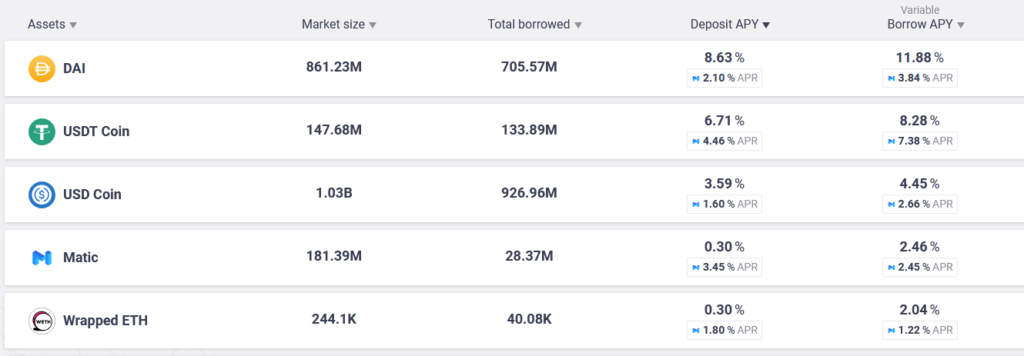

Aave (AAVE), initially ETHLend (LEND), was launched in 2017 by Stani Kulechov as a peer-to-peer lending platform trying to match lenders and borrowers. After a couple of years, the project rebranded as Aave and switched to a lending pool model; ETHLend is now a subsidiary of Aave. Aave built its lending services on the Ethereum network, but they’re also available on Polygon (MATIC) and Avalanche (AVAX).

When you deposit funds in an Aave pool, you receive an equivalent amount of aTokens. Aave uses its aTokens to distribute the interest to the lenders. For instance, if you deposit 100 DAI on Aave, you’ll receive 100 aDAI. Those aDAI will be used by the Aave protocol to distribute your 10.73% yield to your wallet. The other currency used by the Aave protocol is its native currency, AAVE. The AAVE tokens give several advantages to their holders. Firstly, it’s a governance token used to vote on improvement proposals. Secondly, it provides financial advantages like discounted fees when you use AAVE tokens as collateral.

Aave democratized the use of Flash Loans. This type of crypto loan leverage the fact that transactions are finalized after a new block is added. The Ethereum network adds a new block every 13 seconds, and Flash Loans occur in that 13-second interval. Thus, Flash Loans are instantly issued and settled without the need for collateral. Flash Loans rely on smart contracts to set up the terms of the loan.

Compound, a crypto lending platform with advanced tokenization

Compound (COMP) is the main competitor of Aave. The Ethereum network is the base layer for both protocols, and they often borrow innovations from one another. Launched in 2018 by Robert Leshner and Geoffrey Hayes, the project attracted support from prestigious venture funds such as Andreessen Horowitz (a16z) and Bain Capital. In total, Compound raised around $33 million through equity fundraising.

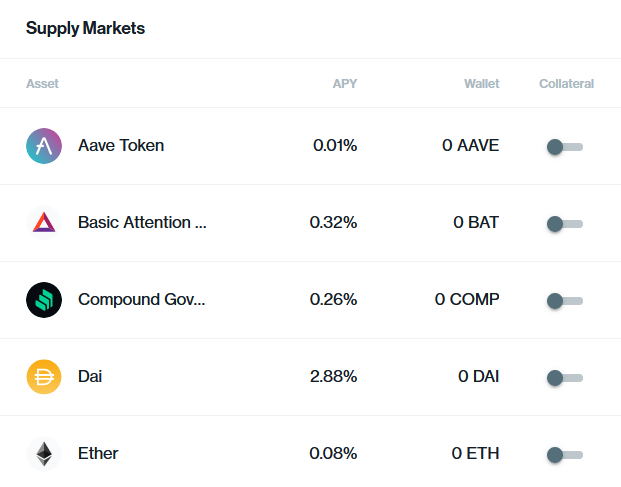

Much like Aave, when a user deposits Compound, a smart contract emits tokens to distribute interest to lenders. Here, the protocols award cTokens to lenders. Each cToken can be redeemed to get back the crypto assets locked in Compound’s pools.

Contrary to Aave, Compound isn’t multichain and operates only on the Ethereum network. The single-chain nature of Compound is a limiting factor for the project. Firstly, the Ethereum network currently has high gas fees, which makes its use prohibitive for small accounts that can pay the gas fees of around $50. Secondly, Compound offers lower annual yields than other projects like Aave.

Like most crypto projects, Compound was relatively centralized in the beginning and suffered some criticism from the champions of decentralization. Down the road, Compound aims to become a fully decentralized autonomous organization (DAO). To begin the transition, Compound issued COMP to all the company stakeholders. However, Compound’s core team still has a failsafe available to suspend the governance system in case of an issue. This centralized control is seen as a genuine lack of decentralization, but the vast majority of crypto projects still operate that way, despite the DeFi label. Moreover, 55.5% of the voting power is currently held by 10 addresses.

Liquity, crypto lending without fee or governance

Liquity is another crypto lending protocol, but with a governance twist. The protocol brands itself as an interest-free and governance-free lending protocol. On the platform, borrowers can subscribe to LUSD (the protocol’s native stablecoin) loans using Ether as collateral without paying interest when they reimburse the loan. Thus, Liquity is an interesting platform if you need to borrow funds at no cost, but less so if you’re looking for yield on your assets. Here, the minimum collateral ratio is 110% (versus 100% on Compound or Aave), meaning that you need $11 worth of Ether to borrow $10 of LUSD.

The other innovation brought by Liquity is its governance-free system. An immutable algorithm handles all the lending operations. Contrary to Compound, Liquity smart contracts have no admin keys and no governance system. This means that Liquity can’t be improved or upgraded and that the project achieved total decentralization from the beginning. The fully decentralized nature of Liquity makes it one of the most decentralized DeFi projects out there.

Concerning Liquity’s future, one question remains: will the protocol pass the test of time?

Having immutable smart contracts provides decentralization, stability, and safety to the users. Yet, imposing permanent stability means giving up on the countless innovations to come in the world of decentralized finance.

Borrowing crypto-asset can be a risky business because of the liquidations happening when the collateral value drops below the imposed collateral ratio. But, if you’re in the crypto world, you should definitely think about lending. By lending your crypto assets to various platforms, you can earn yield to garnish your portfolio even more. Instead of simply holding, you can stake your tokens and provide liquidity on multiple platforms. This is the most effective way to generate passive income in the crypto space.

Recent Comments