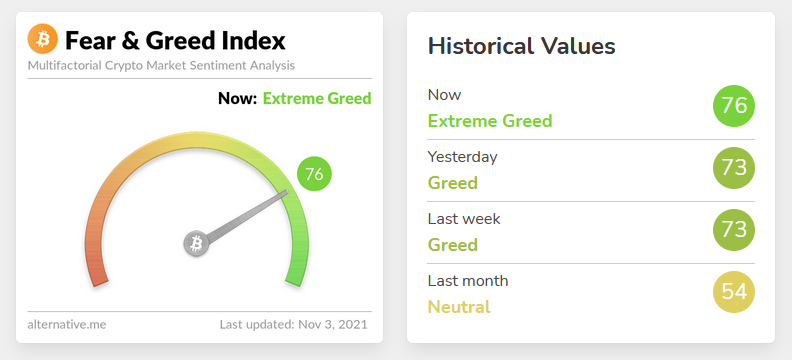

Most of human behavior is dictated by emotions. As a crypto investor, you’ll face two primary emotions: Fear and Greed. The fear of losing the investment makes you sell to a whale at the bottom of a crash. Greed prevents you from selling at the top. Those primal forces drive most of the investor’s behavior, and that’s something you can use to make profits. Indeed, Dopamine gives you access to the Fear and Greed Index to make the most of the crypto market using sentiment analysis.

Take the temperature of the crypto market with the Fear and Greed Index

“Be fearful when others are greedy and greedy when others are fearful”

Warren Buffett

The Fear and Greed Index is an indicator that measures the market sentiment toward cryptocurrencies. The cryptosphere is inhabited by a wide range of profiles, but most market participants are retail traders with no financial background. This makes the crypto market highly emotional, and the index tells you which way those emotions are directed. Thus, the Fear and Greed Index is a valuable tool to stay ahead of changes in market sentiment.

When the market is trending upward, people tend to buy trending crypto assets by Fear Of Missing Out (FOMO); this is greed. On the contrary, when the market is plagued by Fear, Uncertainty, and Distress (FUD), the market participants will panic sell their holding; this is fear. As a rational crypto investor, you don’t want to give in to your emotions; you need to stay on top of them to make substantial profits. When reading the Fear and Greed Index, you can use this rule of thumb:

- Extreme greed means that investors are hyped and buying. As a smart crypto investor, you should sell when people are starting to be extremely greedy.

- Extreme fear means that investors are worried and selling. As a smart crypto investor buying the fear is generally a good move.

How to read the Crypto Fear and Greed Index?

The values on the Fear and Greed Index go from 0 (extreme fear) to 100 (extreme greed); in total, there are 4 ranges for the Fear and Greed Index:

- 0 to 24: Extreme Fear

- 25 to 49: Fear

- 50 to 74: Greed

- 75 to 100: Extreme Greed

How is the Crypto Fear and Greed Index calculated?

There are several Crypto Fear and Greed Index variations, but the most commonly used is the one from alternative.me. But how do they assess market sentiment to build their index? The platform uses 5 metrics linked to Bitcoin to construct this indicator:

- Volatility. The platform measures the current volatily and compares it against Bitcoin’s max volatility and the values from the last 30 and 90 days.

- Market Momentum/Volume. This takes into account trading indicator for momentum like moving averages as well as buying and selling volumes.

- Social Media. The platform gathers post from twitter and perform sentiment analysis to assess market sentiment.

- Dominance. Here, the platform assumes that when Bitcoin’s market dominance is going up, people are fearful and seek a safe haven. On the other hand when Bitcoin’s market dominance shrinks, people are buying riskier altcoins thus being greedy.

- Trends. This last metrics use data from Google Trends for Bitcoin. When search volumes are going up it can indicate that new user lured by greed are entering the crypto market.

As you can see, the Crypto Fear and Greed Index gives us a glimpse of the market sentiment based on subjective metrics. One could pick different metrics and arrive at the same results. It would be best not to consider this indicator, or any other indicator, as The absolute indicator. This index is only a tool that gives us some intel on the market based on an algorithm.

Recent Comments