Yield farming has been one of the hottest trends in the decentralized finance (DeFi) ecosystem. You’ve probably heard about the insane returns that some yield farmers are making. So, what exactly is yield farming?

Yield farming definition and core notions

In the DeFi ecosystem, yield farming refers to optimizing DeFi rewards by using several DeFi protocols. Synthetix set up the first iteration of yield farming on the sETH/ETH liquidity pool on Uniswap. Synthetix incentivized users to provide liquidity on this pair by rewarding them with SNX tokens that could, in turn, be stacked on Synthetix.

Thus, liquidity providers had two types of rewards: the fees from the pool and the governance tokens from Synthetix. Here, you have one of the simplest examples of a yield farming strategy. Yield farming isn’t a standalone process and often involves multiples DeFi protocols.

Yield farming’s popularity truly increased with Coumpound’s liquidity mining program. The program rewarded users for lending and borrowing on Compound with COMP governance tokens. The higher the borrowing interest rate, the higher the COMP rewards. Then, the user could use the newly minted COMP as collateral to borrow even more and receive additional COMP tokens.

Now that you understand what yield farming is, it’s essential to differentiate it from similar concepts:

- Yield farming. Optimizing your DeFi rewards by using multiple DeFi mechanisms or protocols

- Liquidity mining. Providing liquidity on a protocol and receiving governance tokens like COMP

- Staking. Participating in a Proof-of-Stake blockchain network validation by locking your assets to earn rewards

How to calculate your yield farming returns?

In the current state of the DeFi ecosystem, it’s nearly impossible to compute the exact fiat value of your yield farming returns for two main reasons. Firstly, the yields on various DeFi protocols may vary depending on the number of users and the demand for an asset. Secondly, the price of DeFi assets is constantly changing. But, you can get a rough estimate of your return on investment in percent. The two standard metrics used to compute returns are :

- The Annual Percentage Rate (APR). The APR refers to the sum of the interest received over a year. If you lend $1,000 at a 50% APR on Compound, you will receive $1,500 after a full calendar year (365 days).

- The Annual Percentage Yield (APY). The APY is similar to the APR but takes into account the effect of compounding interest. The concept behind compounding interest is simple: each day, week or month you add the interest earned to your initial capital to earn even more interest. You lend $1,000 at 50% a year on Compound, but each day you collect your interest and add them to the lended funds to increase the overall yield. By reinvesting your daily interest (compounding), you would earn a 65% APY instead of a 50% APR.

Yearn Finance, yield farming optimization for everyone

Launched in 2020 by Andre Cronje, a prominent cryptographer, Yearn Finance was the first-ever yield farming optimization protocol. The protocol became increasingly popular all along 2020 because it systematically offered the best yield on several assets. The concept behind Yearn is simple, the platform provides Vaults, and each Vault deploys a different yield farming strategy.

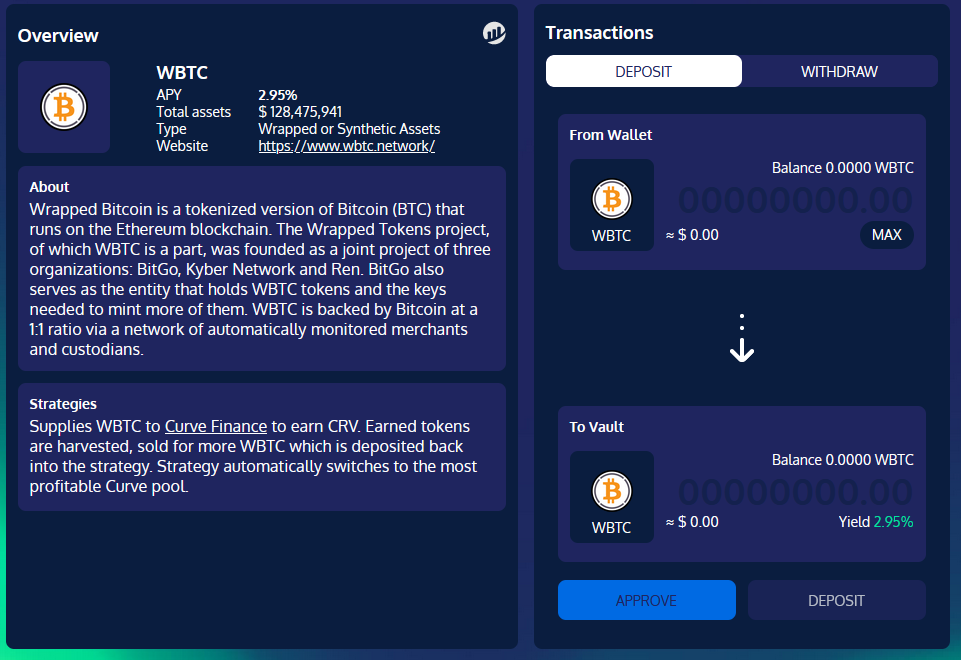

Above, you have an example of a vault on Yearn, the WBTC vault (WBTC are simply BTC transferred to the Ethereum network through cryptographic operations).

When you deposit your WBTC in this vault, Yearn will send them to Curve Finance, a decentralized exchange based on Ethereum. On Curve, the WBTC will earn CRV tokens, the governance token of Curve Finance. Then, the strategy automatically sells those CRV to buy more WBTC and deposits them on Curve to earn more CVR. This process will be repeated each day until you choose to redeem your WBTC.

This yield farming strategy allows you to get a 3% APY on your BTC when standard rates are around a 1% yearly return. This is the true power of yield farming optimization!

Recent Comments