In 2021, stablecoins are both the backbone of the crypto industry and a highly controversial topic. International and national regulators consider them a significant risk to the financial system, mainly because they escape their grip on the wheels of finance. Even crypto-enthusiasts feel uneasy when dealing with the stablecoins, worrying over the reality of the reserves ensuring the stablecoins issued.

But, stablecoin became a crucial element of the crypto ecosystem, so what are they, and how should you use them?

What is a stablecoin?

In the crypto world, stablecoins are crypto-assets designed to bring some stability in a highly volatile market. In essence, stablecoins are cryptocurrencies backed by other assets to ensure their value remains stable. Historically, most are backed by a fiat currency such as the dollar, euro, or yen. Others are more exotic and based on commodities or the value of other cryptocurrencies.

One of the first stablecoins was the Tether USD (USDT). Since its inception in 2014, the USDT has become the literal backbone of the crypto market. Over the last 24 hours, the Tether USD has had a transaction volume approaching $80 billion, and its market cap is nearing $75 billion. In comparison, Bitcoin (BTC) has had $36 billion of transaction volume over the same period, less than half. This difference perfectly demonstrates the significance of stablecoins in the crypto market.

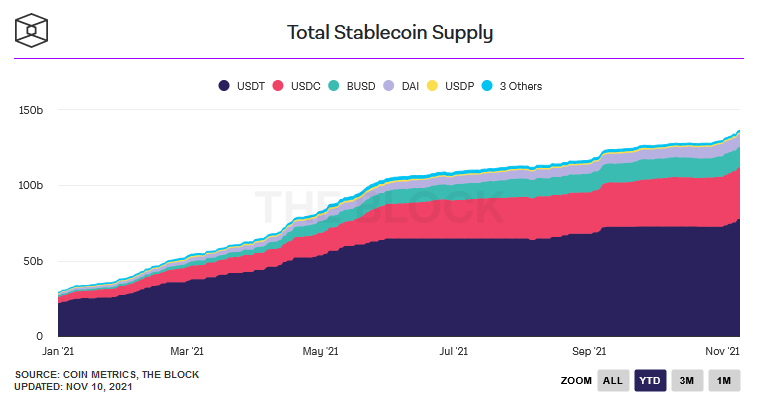

As you can see above, the USDT is the main stablecoin by market capitalization, but USDC issued by Circle in collaboration with Coinbase is becoming increasingly popular. As of 2021, stablecoins represent more than 75% of crypto transactions.

How does a stablecoin work?

Stablecoins are issued either by centralized entities, like Tether Limited (USDT) and Circle (USDC), or decentralized entities, like MakerDAO (DAI). Each issuing entity has to choose a mechanism that ensures its stablecoin maintains its value. If the stablecoin is pegged to the dollar, its value has to remain around 1$. There are several ways to try to stabilize the value of a stablecoin. Each method has advantages and disadvantages in terms of risk and decentralization. There are 4 types of stablecoins:

- Fiat backed stablecoins. The most common backing mechanism for stablecoins. In the case of a dollar-backed stablecoin, the issuer must have 1$ of reserve for each token issued. This ensures that the issuing company is able to buy back all the coins in circulation at any moment in time. The fiat collateral must always remain proportional to the number of stablecoins in circulation.

- Cryptocurrency backed stablecoins. To create this type of stablecoins, market participants must lock up some crypto assets in a smart contract to receive tokens. The most popular crypto backed stablecoin is the DAI from MakerDAO. When you deposti $1,000 worth of Ether in the smart contract you’ll receive up to $500 of DAI. This mecanism called over-collateralization serves as a buffer against price fluctuations.

- Commodity backed stablecoins. Commodity backed stablecoins use physical assets like gold or real estate to maintain their value. Currently, the most used commodity collateral is gold.

- Algorithmic stablecoins. This last type of stablecoin use an algorithm to maintain its value rather than relying on an asset. The algorithm balance the value of the asset depending on the number of coins in circulation and will reduce the number of available tokens if the price of the stablecoin fall below the price of the currency it tracks.

Why do crypto investors use stablecoins and how should you use them ?

In the beginning, stablecoins were designed to solve two issues: the reliance on fiat currencies and the volatility of crypto assets. In the early days of the crypto market, it was nearly impossible for crypto exchanges to get their hands on fiat currencies for their users. The whole banking industry was shunning crypto companies preventing them from accessing bank services and fiat currencies. That’s why Tether Limited launched its USDT stablecoin in 2014.

Moreover, crypto assets have demonstrated their tendency for high volatility. Volatility in itself isn’t a problem; without volatility, there’s no trading and negligible profits. But, since most crypto exchanges aren’t allowed to hold fiat currencies, crypto assets volatility is problematic. When a market crash happens, the value of your portfolio can be divided by two in a few days. This is one of the main reasons why traders and investors use stablecoins.

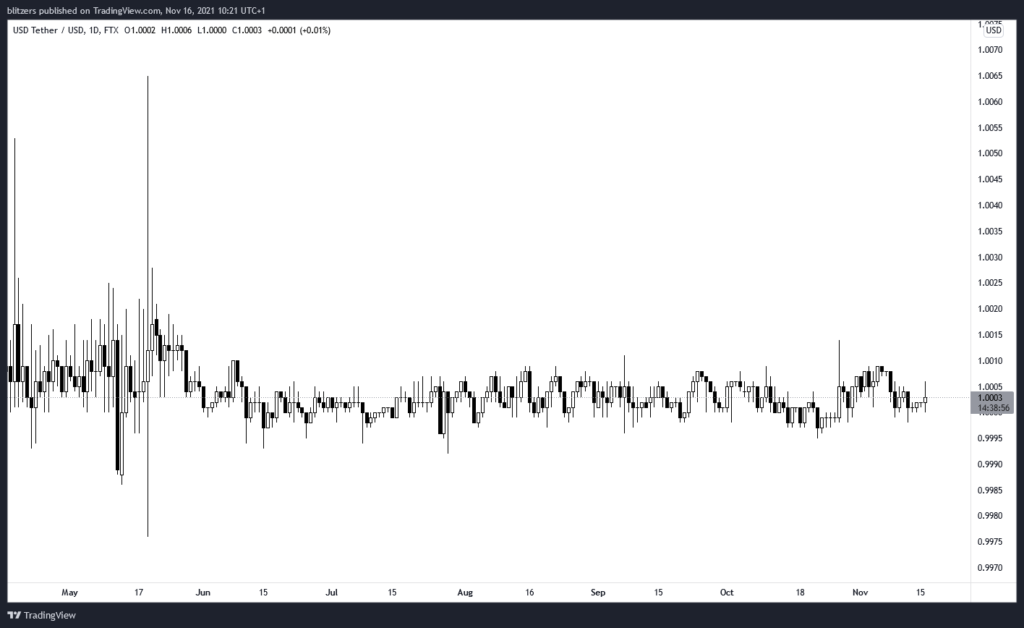

When the market is going up, investors are selling stablecoins to buy crypto, and when the market is going down, investors are selling crypto to buy stablecoins. This causes the value of stablecoins to fluctuate around their peg value, as you can see below.

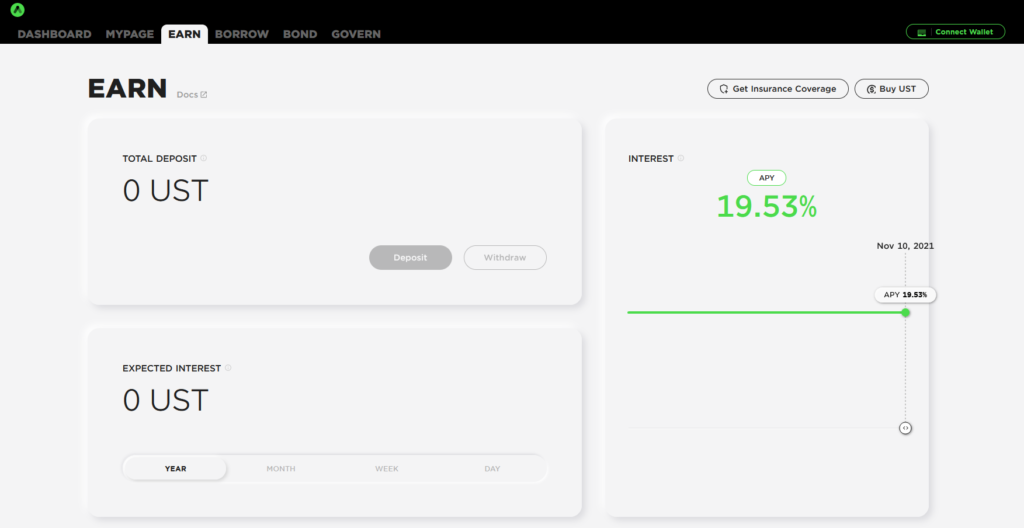

As a crypto investor, these assets will serve two purposes for you; being a safe haven asset for periods of high volatility and being a secured passive income source. Indeed, with the rise of decentralized finance (DeFi), stablecoins became an exciting way to generate passive income, with annual yields going from 4% to 20%. For instance, the Anchor Protocol offers a 19.53% yearly yield on Terra USD (UST) deposits.

Stablecoins and their controversies

Since their inception, both centralized and decentralized have been riddled with controversy. Paradoxically, the most controversial stablecoin is the market leader: Tether USD. In 2017, some analysts accused Tether Limited and the USDT of being at the center of market-wide Bitcoin price manipulation. Then in 2018, Tether Limited faced accusations of not having enough US dollars to ensure the 1:1 ratio with the USDT.

Between 2018 and 2021, Tether Limited’s reserve size remained a mystery. However, in May 2021, Tether published the composition of its reserve for the first time, proving the USDT was fully backed but not by US dollars. Most of Tether’s reserves are composed of short-term debt.

Lastly, algorithmic stablecoins are subject to exploits and failures if they’re not set up properly. Below you have the Iron (IRON) chart, which belongs to this sub-category of stablecoins. Despite its algorithmic peg, the stablecoin lost 25% of its value in early July and even caught off guard crypto investor and billionaire Mark Cuban. Algorithmic stablecoins aren’t that stable, but this type of crypto asset is still in its infancy and will definitely improve over the years.

Now you should better understand the so-called stablecoins and the logic behind this kind of crypto assets. While keeping your funds in fiat currencies might be the safest bet, stablecoins allow you to minimize your transaction fee and quickly convert crypto-assets into safe-haven assets. This can be particularly useful when the market is trending down, and you want to get out of the market for a few days.

Recent Comments